Not very long ago, it was fashionable to ask if millennials would ever crawl out of their parents’ basements and into a realtor’s office. Enthusiasm for that view, which had gained wide exposure by 2012, lost steam as mortgages got easier to come by and millennials kept insisting that no, actually, they do want to own a home.

Category: TCN Blog

Brexit benefits US homebuyers by triggering lower interest rates

Jonathan Smoke – Realtor.com

The surprise victory in Britain of the campaign to leave the European Union may be spurring panic across the Continent (and among some regretful British voters), but “Brexit” has left U.S. home buyers with a very definable windfall: mortgage rates that are now the lowest they’ve been in more than three years.

Four Reasons Why Lenders Will Soon Embrace E-Closings

Alec Cheung – National Mortgage News

Electronic signature technology has been available — as far back as June 30, 2000 when President Clinton signed the Electronic Signatures in Global and National Commerce Act, which could reasonably lead one to expect that electronic closings would be used routinely by now. Yet, while more stages of the mortgage origination process continue to go digital, this is one stubborn piece of the puzzle that fails to follow suit.

The Importance of the Title Commitment

Brian Bonham – JDSupra.com

When you are purchasing a home (or any type of property) the last thing you are thinking about (unless you are a real estate attorney) is the title commitment. The focus is generally on the big ticket items such as purchase price, closing date, and inspection contingencies. However, almost every real estate purchase agreement provides for the issuance of a title insurance policy to the buyer (and buyer’s lender if applicable) and the title commitment is the title company’s promise to issue a title policy to you at closing. So why is the title commitment so important and why should you review it carefully?

The Numbers Are In: Yup, 2016 Is Off to a Good Start in Home Sales

Jonathan Smoke – realtor.com

We may be on the verge of spring, but housing and economic reports work on a bit of a lag time. We’ve only just gotten the major data reports for January, and it’s giving us a clear-eyed view of how the real estate market is measuring up this year.

And yeah, things are looking good.

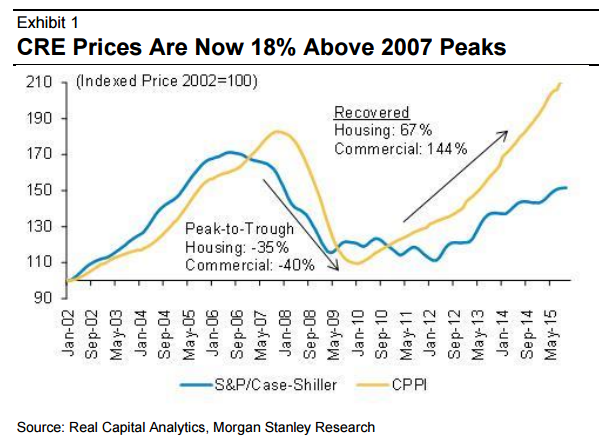

Morgan Stanley Says U.S. Commercial Real Estate Price Growth Will Be Flat

Tracy Alloway – Bloomberg

Morgan Stanley analysts last week predicted U.S. commercial real estate prices would grow by a big fat zero percent in 2016, replacing a previous forecast of 5 percent growth over the course of the year.

It was a surprising prediction for a market which has seen prices easily blow past their pre-financial crisis highs. Values for office buildings, hotels, shopping malls and the like have appreciated rapidly in recent years, thanks in part to insatiable investor demand for higher-yield commercial real estate assets.

Google Shuttering Mortgage Comparison tool

Ben Lane – Housingwire

Exactly four months to the day after announcing that it was launching a mortgage comparison tool via its Compare service, multiple reports say Google is shutting down its entire Compare service in both the U.S. and the U.K.

Cater to Boomers or Millennials? Homebuilders Caught In Between

Steve Brown – the Dallas Morning News

“The U.S. housing industry is being pulled in two directions.

Baby boomers with big housing bucks to spend still rank at the top of many builders’ customer lists.

But rising sales to millions of millennials have sent builders scrambling to tailor houses for the next generation of buyers.”

Millennials Making Mark on Housing Market

Bill Lewis – The Tennessean

“When Chase Geiser bought his first house last summer, a 1930s home near downtown Nashville, he was looking for a good investment in an up-and-coming neighborhood. He also became part of a new wave of millennial generation home buyers who are changing neighborhoods and home design across the region.”

Using Technology to Close a Mortgage, and Relieve Stress

Ann Carrns – The New York Times

“Anyone who has purchased a home knows how stressful the closing of a mortgage loan can be.

A typical closing — the meeting to complete the loan — involves signing stacks of legal-size documents laden with financial jargon. Borrowers may be anxious about the amount of money involved and worry about whether they understand the forms they’re signing. Document packages can total 100 pages or more, and closings can take hours.

That’s why some lenders are starting to automate the process, using technology to create “e-closings” that require fewer paper documents.”